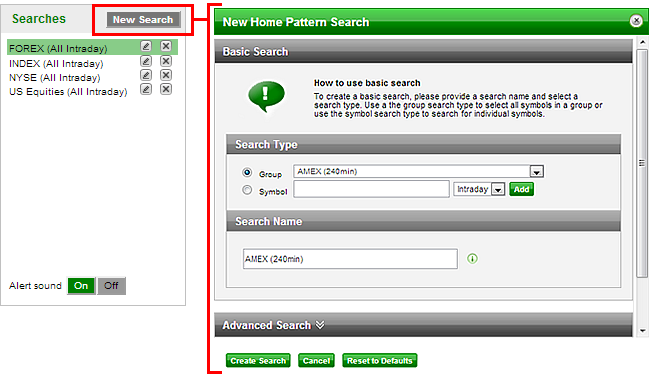

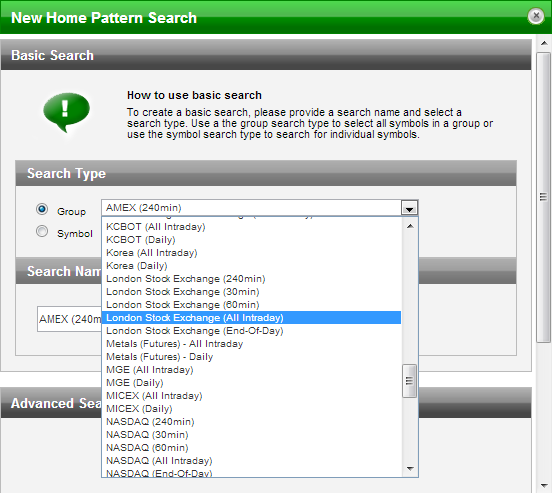

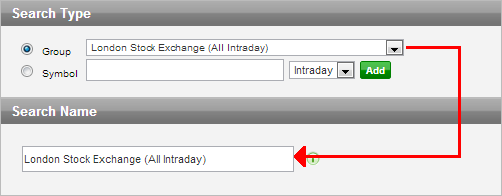

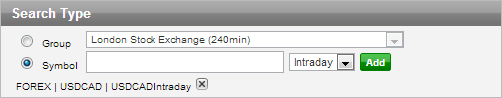

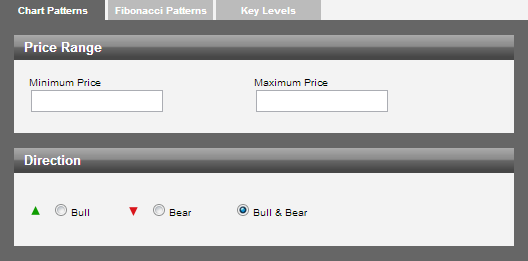

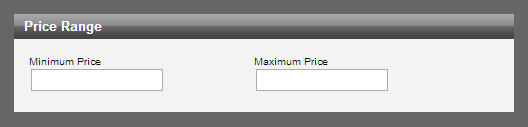

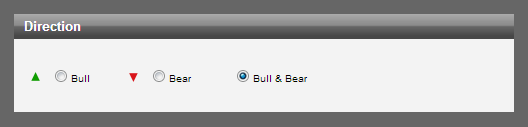

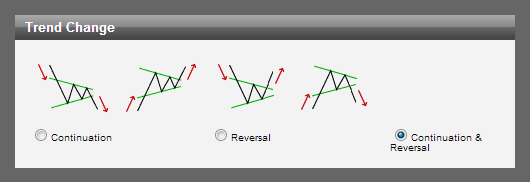

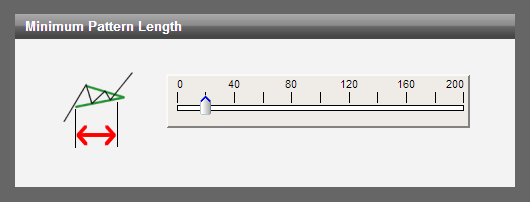

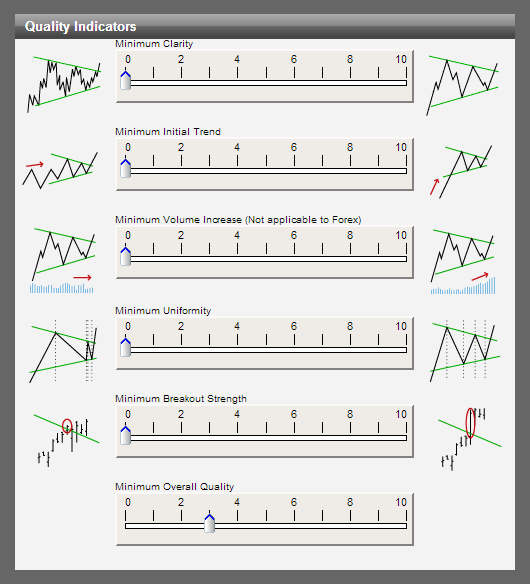

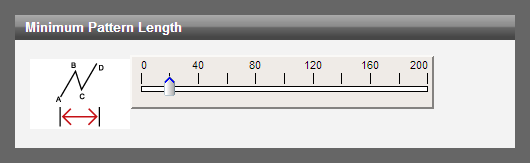

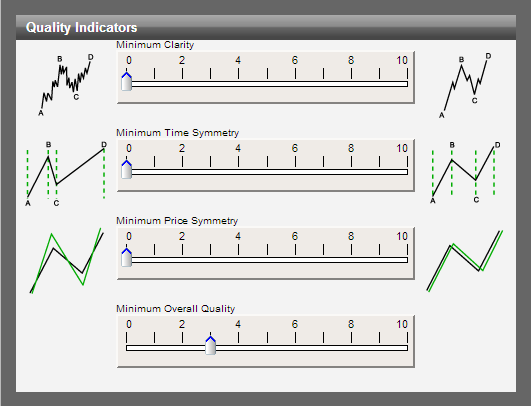

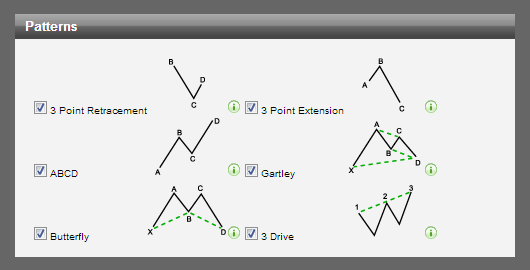

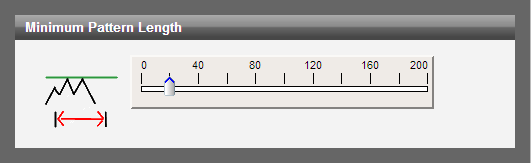

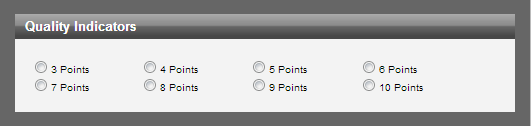

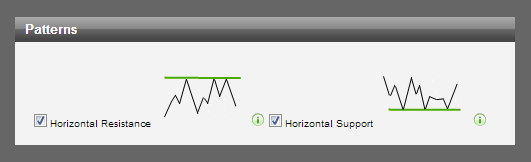

Introduction The Autochartist Interface Our Favourites (A) Trading Opportunities (B) Event Impact Analysis (C) Performance Statistics (D) Messaging & Alerts (E) Trading Community (F) Search Pane (G) Pattern Display (H) Price Movement Pane (Volatility Analysis) (I) Sound Switch (J) Results Filter (K) Active Trading Opportunities (L) Expired Trading Opportunities (M) Creating and Editing a Search Basic Search Search Name Advanced Search Filters Advanced Filters: Chart Patterns Advanced Filters: Fibonacci Patterns Advanced Filters: Key Levels Emerging vs Complete Results Emerging Chart Patterns Emerging Fibonacci Patterns Support |

Chapter 3 CREATING AND EDITING A SEARCH |