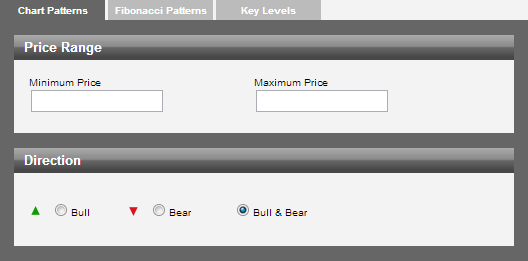

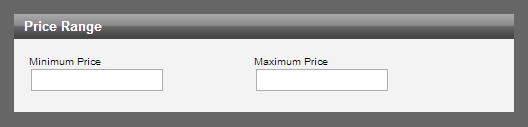

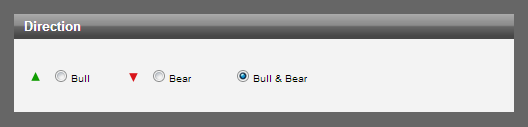

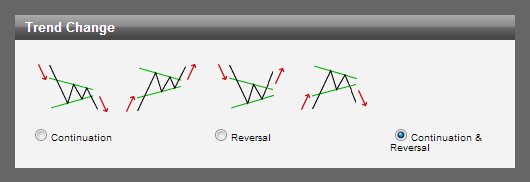

Introduction The Autochartist Interface Our Favourites (A) Analysis Toolbar (B) Event Impact Analysis (C) Performance Statistics Tab (D) Messaging & Alerts Tab (Market Reports)(E) Education & Resources Tab (F) Search Pane (G) Pattern Display (H) Price Movement Pane (Volatility Analysis) (I) Sound Switch (J) Results Filter (K) Results Pane: Active Trading Opportunities (L) Results Pane: Expired Trading Opportunities (M) Creating and Editing a Search Basic Search Search Name Advanced Search Filters Advanced Filters: Chart Patterns Advanced Filters: Fibonacci Patterns Advanced Filters: Key Levels Emerging vs Complete Results Emerging Chart Patterns Emerging Fibonacci Patterns Support |

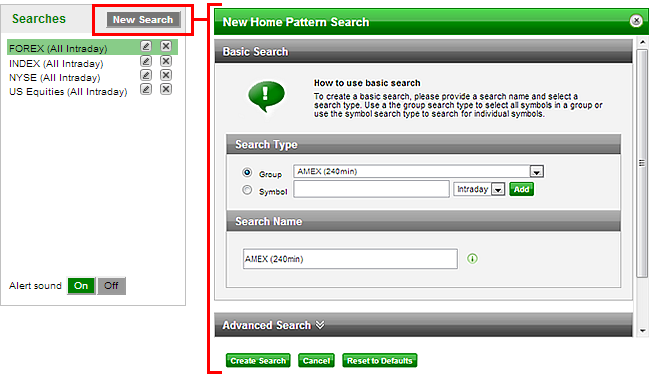

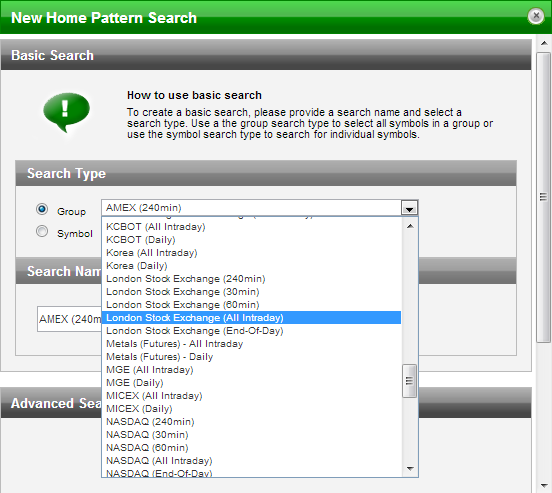

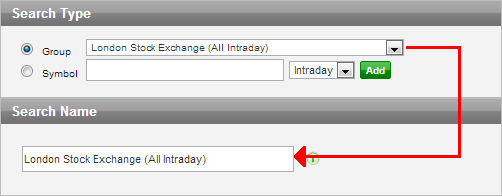

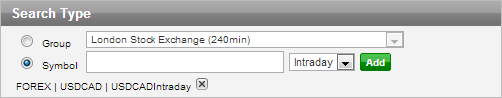

Chapter 3 CREATING AND EDITING A SEARCH |

|

Autochartist User Manual

DISClAIMER: The Autochartist service includes chart pattern identification in respect of foreign currencies, commodities, equities and stocks.

There are potential risks relating to investing and trading. You must be aware of such risks and familiarize yourself in regard to such risks and

to seek independent advice relating thereto. You should not trade with money that you cannot afford to lose. The Autochartist service and its

content should not be construed as a solicitation to invest and/or trade. You should seek independent advice in this regard. Past performance

is not indicative of future performance. No representation is being made that any results discussed within the service and its related media

content will be achieved. All opinions, news, research, analyses, prices or other information is provided as general market commentary and

not as investment advice. Autochartist, MDIO Software, their members, shareholders, employees, agents, representatives and resellers do

not warrant the completeness, accuracy or timeliness of the information supplied, and they shall not be liable for any loss or damages,

consequential or otherwise, which may arise from the use or reliance of the Autochartist service and its content.

For further support or information please visit www.autochartist.com or e-mail techsupport@autochartist.com